Table of Content

This is a good option for borrowers who expect to live in their homes long-term. Remember, if rates drop sharply, you are free to refinance and lock in a lower rate and payment later on. In most other cases, a fixed-rate mortgage is typically the safer and better choice.

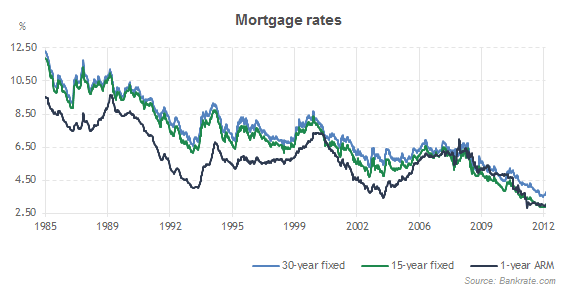

To see where mortgage rates are headed, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on mortgages where the borrower has a 740+ FICO score, 20% equity or more, and the home is occupied by the owner. For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan. The kind of loan you're applying for can influence the mortgage rate you're offered.

Check your rates today with Better Mortgage.

The APR is the total cost of your loan, which is the best number to look at when you’re comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so you’ll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate. For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

Bankrate cannot guaranty the accuracy or availability of any loan term shown above. Bankrate is an independent, advertising-supported publisher and comparison service. We are compensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to strict editorial guidelines. The first rate you’re quoted may not be your best interest rate.

FHA mortgages

The rates shown above are calculated using a loan or line amount of $30,000, with a FICO score of 700 and a combined loan-to-value ratio of 80 percent. Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration and Veterans Affairs mortgages.

The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision. Rates from different lenders and apply with at least three to see if you can get the best deal.

Consider different types of home loans

If that’s not the case, their interest rates could end up being markedly higher after a rate adjusts. Mortgage rates have been pushed up primarily by the highest inflation in four decades. The consumer price index showed prices up 7.7% year-over-year in October, compared to 8.2% in September. Inflation has remained higher than expected, but appeared to be slowing down in October. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate. Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with a 20% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii).

Conventional fixed-rate mortgages

It's a good idea to lock the rate when you're approved for a mortgage with an interest rate that you're comfortable with. Consult with your loan officer on the timing of the rate lock. Ideally, your rate lock would extend a few days after the expected closing date, so you'll get the agreed-upon rate even if the closing is delayed a few days. Are basically prepaid interest that reduces the interest rate on your mortgage. One discount point costs 1% of the loan amount, and will usually drop the interest rate by 0.25%. Mortgage insuranceinto account, which is why it's usually higher than the interest rate.

It’s easier to shop around when refinancing because you don’t have to worry about the other hurdles of the homebuying process, so take advantage of that flexibility. Unlike buying a house and getting a new mortgage, you’ve got more flexibility when deciding to refinance. For starters, you don’t have to worry about finding the house. There are a few reasons to refinancing and plenty of advantages if you do it at the right time. Find the mortgage that’s best for you by comparing the cost of multiple loans over time.

2.65 percent is the lowest average mortgage rate ever recorded by Freddie Mac’s Primary Mortgage Market Survey on conventional 30-year fixed-rate mortgages. But the APR you pay on a loan is often just as or even more important than the basic interest rate. Your credit score is one of the biggest factors in determining your mortgage rate, especially if you use a conventional loan.

Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but you’ll typically pay a higher interest rate. If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. But you can get lower mortgage rates with some adjustable-rate loans too.

At the time this was written in Nov. 2022, the average 30-year fixed rate was 6.61% according to Freddie Mac’s weekly survey. That represents all sorts of borrowers, and those with strong finances can often get rates well below average. Right now, good mortgage rates for a 15-year fixed loan generally start in the 5% range, while good rates for a 30-year mortgage generally start in the 6% range. To understand what a good mortgage rate looks like for you, get quotes from a few different lenders and compare them. This will show you the range of interest rates you’re eligible for and help you pick the cheapest lender for your situation.

Your bank statements and investment accounts will provide a larger picture of how much money you might have available to cover your mortgage. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice. Finally, when you’re comparing rate quotes, be sure to look at the APR, not just the interest rate.

Skiba noted that investors also were disappointed by the fact that the Fed is now saying that interest rates could end next year at 5.1%...higher than the 4.6% projection in September. "That could have given the Fed reason to cut rates in back end of 2023 if a recession is coming," Skiba said, adding that rate cuts are probably now not in the cards until 2024. Even as the Fed slows its rate hikes, it's not going to quickly lower them -- even if the economy starts to slump. Inflation, Powell says, is the enemy the Fed has its sights on.

No comments:

Post a Comment